Thinking about starting a real estate business but unsure where to begin?

The real estate industry offers diverse opportunities, from managing residential properties to engaging in commercial real estate investments or property development.

But how to start a real estate business?

To succeed, it’s important to understand the ins and outs of the industry. Real estate can be unpredictable, influenced by factors like demand, property values, and economic shifts.

So, having a solid grasp of local market trends, legal regulations, and financial processes is essential.

You'll also need to explore various financing options and be aware of the risks that come with real estate investments. Each real estate sector, whether residential, commercial, or specialized, has its own set of challenges and rewards.

Another key to success? Networking. Building relationships with agents, brokers, contractors, and legal experts can open up valuable resources and support as you grow your business.

All this and much more, this blog explores everything you need to know about starting your own real estate business.

U.S. Housing Market: Trends and Outlook

Before investing in the real estate business, you must understand the dynamics of the industry.

Nationally, home prices have shown a modest year-over-year increase of 1.7% as of July 2025, indicating a deceleration from previous years. This slowdown is attributed to high mortgage rates and limited inventory, which have kept many potential buyers on the sidelines.

Moreover, cities like New York are repurposing underutilized office spaces into residential units to address housing shortages and adapt to changing work patterns.

Also, the rise of artificial intelligence companies is revitalizing demand for office spaces in tech hubs like Silicon Valley, reversing previous trends of remote work dominance.

Despite certain market uncertainties, large investment firms like Carlyle have successfully raised significant funds for U.S. real estate investments, focusing on sectors like residential, self-storage, and industrial properties.

With home prices at record highs and continuing to rise in many markets, it’s natural to think about a potential housing bubble, similar to the 2008 financial crisis.

However, the chances of a housing market crash (a sharp decline in prices driven by reduced demand) are low in 2025. While housing inventory has increased significantly compared to last year, it still remains well below pre-pandemic levels.

9 Steps to Start a Real Estate Business

Starting a real estate business involves careful planning and strategic decision-making. By following a structured approach, you can lay the foundation for a successful venture in this dynamic industry.

Below are the essential steps to get started:

- Conduct market research

- Create a business plan

- Obtain necessary licenses and certifications

- Secure financing for your business

- Set up your business infrastructure

- Build a strong network

- Market your real estate business

- Start building your portfolio

- Track your progress

Let’s explore each step in detail:

1. Conduct Market Research

Analyze local market trends, property values, demand, and competition to identify opportunities and determine your niche in real estate.

Here are two ways to conduct market research:

- Before starting a real estate business, it’s essential to understand the local market. This includes analyzing current trends, property values, demand, and competition.

- By examining the market, you can identify which areas are growing or declining and make informed decisions about where to invest. Understanding niche opportunities such as short sale in real estate can also help you find undervalued properties and make strategic investments aligned with your goals.

- Understanding the demand for specific property types, such as residential, commercial, or industrial, will help you align your business strategy with market conditions.

Once you’ve analyzed the local market, it’s important to determine which niche within real estate you want to focus on. Do you want to specialize in residential properties, commercial real estate, or rental properties? Each niche comes with its own set of challenges and rewards. with more complex transactions.

Identifying your niche will help you target the right clients and tailor your services to meet their needs, making your business more competitive and successful.

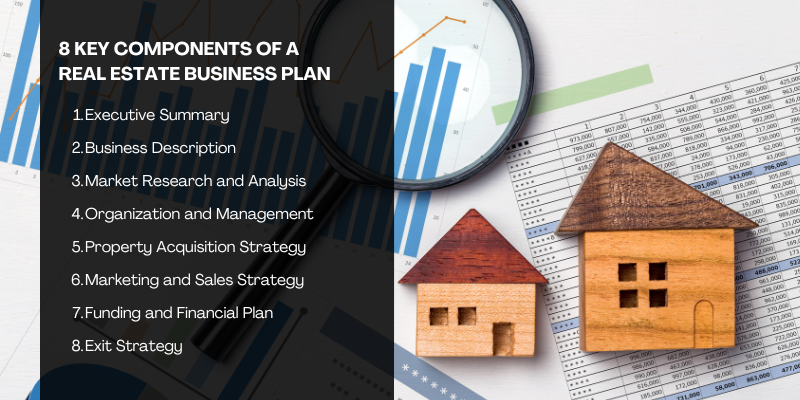

2. Create a Business Plan

A business plan acts as a roadmap, guiding you through the complexities of the real estate market, helping you secure funding, and providing clarity on your objectives and strategies.

Whether you're just starting out or looking to scale, your business plan will be instrumental in defining your direction, attracting investors, and ensuring long-term success in the competitive real estate industry.

Here are the key components to include in your real estate business plan:

-

Executive Summary

Provide a concise overview of your real estate business, outlining its purpose, goals, and the types of properties you will focus on. This section should clearly define your vision for the first few years of operation.

-

Business Description

Explain the nature of your business, specifying whether it involves property flipping, rentals, or development. Highlight what sets your business apart from competitors in the market.

-

Market Research and Analysis

Research the local real estate market, identifying trends, demand, and competitive properties. Understand your target audience and market conditions to make informed investment decisions.

-

Organization and Management

Detail the structure of your business, including roles for key team members like agents, managers, and contractors. Define the responsibilities and contributions of each individual in your real estate operation.

-

Property Acquisition Strategy

Outline your method for acquiring properties, focusing on criteria such as location, price, and condition. Establish a clear acquisition process to ensure successful property investment.

-

Marketing and Sales Strategy

Describe your plan to market properties through digital platforms, networking, and open houses. Develop strategies for generating leads and converting them into sales or rental agreements.

-

Funding and Financial Plan

Identify the sources of funding for your business, whether through loans, private investors, or savings. Provide financial projections including revenue expectations, costs, and funding requirements.

-

Exit Strategy

Define how you plan to exit your investments or business. Whether selling properties for profit, refinancing for cash flow, or other methods, establish clear milestones and timelines for your exit.

This will help you stay on track and ensure the financial sustainability of your real estate business.

3. Obtain Necessary Licenses and Certifications

Research and acquire the required licenses and certifications for your area, and choose the appropriate legal structure for your business.

Research local licensing requirements and obtain the necessary certifications to legally operate in real estate.

Understanding how to get a real estate license in USA is a crucial step for compliance, as it ensures you can legally represent clients and handle property transactions.

Decide on your business’s legal structure, such as an LLC, sole proprietorship, or corporation, based on your goals and liability preferences.

4. Secure Funding for Your Business

Determine the capital needed to start your real estate business and explore funding options like loans, private investors, or partnerships.

Before starting a real estate business, it's crucial to determine how much capital you'll need to launch and operate your business.

This includes estimating startup costs such as marketing, office space, legal fees, and initial property investments.

Additionally, consider your ongoing expenses, such as staff salaries, property maintenance, and operational costs.

Knowing the total amount of money required will help you decide how much funding you need and the best way to secure it.

There are several ways to fund your real estate business.

Some of the most common ones include:

- Traditional Bank Loans: Requires good credit and a solid business plan.

- Private Investors: Offers funding in exchange for equity or returns on investment.

- Partnerships: Collaborate with other professionals to pool resources.

- Crowdfunding: Raise funds from a large group of people online.

- Hard Money Loans: Short-term loans based on property value.

- Seller Financing: Property seller finances the purchase directly.

- Home Equity Line of Credit (HELOC): Borrow against property equity.

- Government Grants/Loans: Low-interest loans or grants for specific projects.

It's essential to explore various funding sources, evaluate the pros and cons of each, and choose the one that aligns with your business goals and financial capacity.

5. Set Up Your Business Infrastructure

How to start a real estate business?To set up your real estate business infrastructure begin by registering your company and selecting the right legal structure.

Secure the appropriate insurance, such as property, liability, and business insurance, to protect your assets.

Lastly, open a dedicated business bank account to keep your personal and business finances separate, ensuring clear financial management.

These are some of the major steps to be taken to setup your business:

- Create a legal entity: Register your business and choose the appropriate structure (LLC, sole proprietorship, corporation) based on your goals and liability needs.

- Get insurance: Ensure you have the necessary coverage, including property, liability, and business insurance, to protect your assets.

- Set up a business bank account: Open a dedicated business account to separate your personal and business finances, ensuring better financial management and tax tracking.

6. Build a Strong Network

Building a strong network is essential for success in the real estate business. By establishing relationships with key industry professionals, such as real estate agents, brokers, investors, contractors, and lenders, you can gain valuable insights and open doors to new opportunities.

Networking provides access to potential deals, parnerships, and referrals, helping you grow your business and stay competitive.

Additionally, joining local real estate associations allows you to connect with others in the industry, stay informed about market trends, and participate in events that enhance your knowledge and credibility.

- Build relationships with real estate agents, brokers, investors, contractors, and lenders to expand your network.

- Gain valuable insights and opportunities by connecting with industry professionals.

- Join local real estate associations to stay updated on trends, regulations, and best practices.

7. Market Your Real Estate Business

Marketing your real estate business effectively is key to attracting clients and building a strong reputation. Start by developing a solid brand and establishing an online presence.

A professional website with detailed property listings and services will help showcase your expertise and make it easy for potential clients to find you.

Utilize social media platforms, best lead generation for realtors, and other tools to engage with your audience, share property updates, and highlight your services.

Additionally, leverage digital marketing strategies to increase your visibility. Implement search engine optimization (SEO) techniques to improve your website’s ranking on search engines, making it easier for potential clients to discover you.

Pay-per-click (PPC) advertising can drive targeted traffic to your website, while email marketing campaigns allow you to nurture leads and keep potential clients informed about new listings and updates.

- Create a professional website with property listings and service information.

- Use social media platforms to engage with potential clients and showcase your expertise.

- Implement SEO to boost search engine rankings and increase organic traffic.

- Use PPC ads and email marketing to attract leads and convert them into clients.

Consider partnering with a specialized real estate marketing agency like Centric, which provides tailored campaigns to improve brand visibility and generate quality leads. By leveraging professional expertise in branding, design, and audience targeting, you can amplify your presence and gain a competitive edge in your local market.

Explore Our Digital Marketing Services!

8. Start Building Your Portfolio

When starting your real estate business, the first step is choosing properties that align with your specific business goals.

If your focus is on resale, you should look for undervalued properties that have the potential for appreciation with some renovations.

On the other hand, if you're aiming for rental income, select properties in areas with high demand and stable rental markets.

Whether you plan to flip homes or create a rental portfolio, make sure the property fits within your long-term strategy and financial objectives.

Here are the 7 key components to include in your real estate portfolio:

- Property Listings: Include details of each property, such as type, location, size, and unique features. This showcases the diversity of your investments and the scope of your portfolio.

- Investment Goals and Strategy: Outline your objectives, such as generating rental income or flipping properties for profit. This helps demonstrate your strategic approach and long-term vision.

- Market Analysis: Provide insights into the market trends, demand, and property values in your investment areas. This shows your knowledge of the market and informed decision-making.

- Financials: Include revenue, operating expenses, cash flow, and profitability. This provides a clear picture of your portfolio's performance and financial health.

- Before and After Photos: Share images that show the condition of properties before and after investment or renovation. This highlights the value you’ve added to the properties.

- Lease Agreements and Contracts: Include key documents like leases, property management contracts, and purchase agreements. These demonstrate your business operations and legal compliance.

- Success Stories and Testimonials: Include positive feedback from tenants, partners, or clients. This builds credibility and showcases the success of your real estate ventures.

By carefully selecting and managing properties, and diversifying your portfolio, you can create a strong foundation for your real estate business, ensuring long-term success and profitability.

When managing your properties, you’ll often come across terms like what does contingent mean in real estate, which refers to a property under contract with specific conditions that must be met before the sale is finalized. Understanding such terms is vital for making informed investment decisions. Whether flipping homes or renting, make sure the property fits within your long-term strategy and financial goals.

9. Track Your Progress and Scale Your Business

To ensure the success of your real estate business, it’s essential to track your progress and scale effectively. Start by monitoring your financial performance, including income, expenses, and returns on investment (ROI).

This helps you make informed decisions and identify areas for improvement. As your initial ventures become successful, focus on expanding your portfolio by exploring new investment opportunities.

Scaling your business involves strategically acquiring additional properties or entering new markets to increase profitability and growth.

- Track income, expenses, and ROI to assess financial performance.

- Identify profitable areas and optimize your business operations.

- Explore new investment opportunities to expand your portfolio.

- Look for ways to scale your business by targeting additional properties or markets.

Conclusion

Now that you know how to start a real estate business, it’s time to take action and begin turning your vision into reality. With a solid foundation of planning, research, and strategic decision-making, you’re equipped to navigate the challenges and seize the opportunities within the real estate market. By focusing on key aspects such as market research, networking, securing funding, and building a strong portfolio, you’ll be on your way to establishing a profitable business. Stay proactive, track your progress, and continuously adapt to market trends. The real estate industry offers endless possibilities, and with the right approach, you can achieve long-term success and growth.